The gaming industry is going through rough times.

Mobile game development has become extremely expensive and is no longer an indie-friendly space.

While Steam games can still rely on organic traffic, communities, and influencers, mobile games live in paid ads only mode.

Success rates are low.

Development cycles take a year or more.

Margins are nowhere near what they were in 2019.

So it’s no surprise that the founders of gaming studios are actively looking for opportunities in consumer apps.

Today I want to talk about a niche that, in just 1-2 years, went from zero to tens of millions of dollars in monthly revenue.

Do you remember Quibi?

In 2020, it was one of the hottest Hollywood startups.

The idea was simple and, honestly, reasonable: people don’t want 30–60 minute episodes anymore. They want vertical, short-form series with episodes 3-5 minutes long.

Quibi raised around $1.7-1.8B in funding.

Six months after launch, the company shut down – one of the most expensive failures in recent tech history.

Now fast forward to today.

Meet:

DramaBox: ~$30M monthly revenue

ReelShort: ~$35M monthly revenue

Netshort: ~$15M monthly revenue

GoodShort: ~$12M monthly revenue

And at least a dozen more similar apps are doing meaningful numbers.

With another dozen being built right now.

I personally know several gaming companies that used to make millions per year at their peak. Their founders gave up on games and moved into vertical drama apps instead.

So what went wrong with Quibi, and why did ReelShort reach nearly $500M in annual revenue in just two years?

Quibi tried to make premium, high-quality content.

Drama apps produce low-quality content slop.

This is the same principle as pulp fiction:

aggressive hooks at the start of every episode

cliffhangers at the end

extremely low-cost production

Before the user realizes what’s happening, they’re paying to unlock the next episodes.

The most impressive part is the marketing.

Meta Ads is the primary acquisition channel for all these apps.

And the creatives are literally episodes pulled from the app's content.

Which means:

creative production costs ≈ zero

creatives perform well by default, because the content itself is designed to hijack attention

Some numbers for context:

ReelShort

50,000+ creatives in Meta Ads Library

~3,700 active ads

DramaShorts

50,000+ total creatives

~2,300 active ads

Netshort

~50,000 creatives total

~1500 active ads

Many of these apps also operate multiple fan pages.

Keep these numbers in mind next time you judge a traffic source based on testing a couple of creatives. The volume of tested ad creatives has always been what separates good marketing from bad. Now, with today’s competition and Meta’s current algorithms, creative volume is the main metric you should be looking at.

What’s even funnier:

Many new players don’t even produce content themselves. They outsource everything to companies that have essentially built factories for generating vertical drama series.

Monetization:

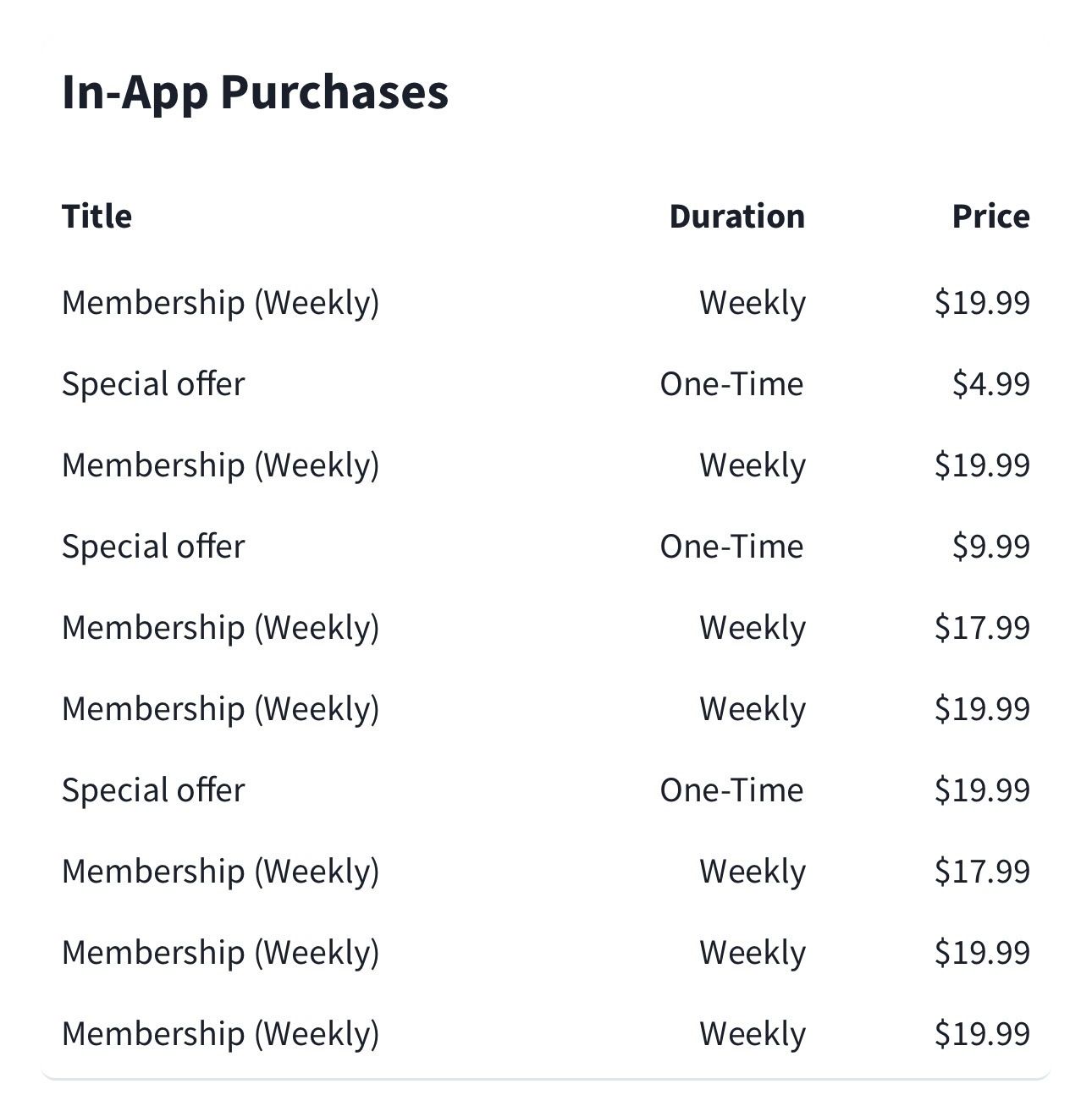

subscription

some apps are testing IAPs

The interesting part: subscriptions cost $19 per week.

After seeing that, the usual $5–8 weekly subscriptions suddenly don’t look that aggressive anymore.

So what you get is a nearly perfect business model:

content production is outsourced

content doubles as ad creatives

monetization via subscription + IAP

an app that scales extremely well with paid ads

a very high revenue ceiling

There aren’t many consumer app verticals today that can realistically generate $10M+ in monthly revenue. Short-form drama is one of them.

That's it for today. Got a topic you want me to dig into? Reply to this email. I'm slow, but I read everything.

See you next week, Ivan.